Online Games : Valuation & Classification of Service : GST Law of India

Por um escritor misterioso

Last updated 19 maio 2024

OIDAR in India: 2023 and Beyond

crypto tax: Govt working on classification of cryptocurrency under GST law - The Economic Times

gst: Government notifies valuation methodology for calculating GST on online gaming, casinos - The Economic Times

Value-added tax - Wikipedia

Lok Sabha Passes Amendments To GST Bills To Tax Online Gaming, Horse Racing and Casinos At 28%

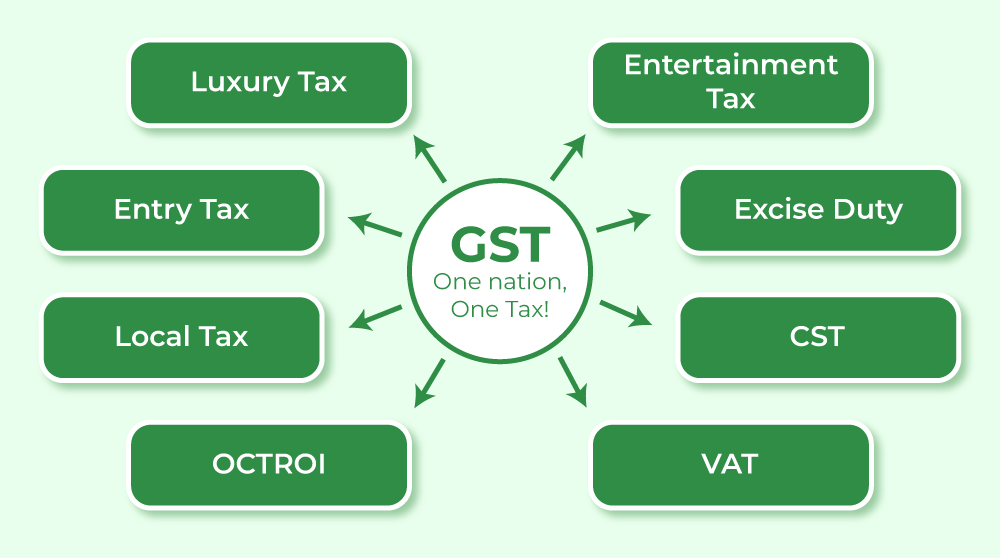

GST in India 2023 - Detailed Guide about Goods & Services Tax

Is tax regime for online gaming fair? - The Hindu BusinessLine

Online Games : Valuation & Classification of Service : GST Law of India

What is GST? Types, Features, Benefits, Input Tax Credit, GST Council - GeeksforGeeks

Online gaming industry seeks inspiration from global practices

GST Council to also tax online gaming transactions in virtual digital assets at 28%

Recomendado para você

-

Play Games Online Free Games at19 maio 2024

Play Games Online Free Games at19 maio 2024 -

Free Online Games - Play-on-line.co.uk19 maio 2024

-

The 10 Best Online Games to Play - 10 Online Games You Should Play19 maio 2024

The 10 Best Online Games to Play - 10 Online Games You Should Play19 maio 2024 -

Play Best Free Online Games at19 maio 2024

Play Best Free Online Games at19 maio 2024 -

Play Free Online Games, Best Games19 maio 2024

Play Free Online Games, Best Games19 maio 2024 -

Free Online Games Over the Years19 maio 2024

Free Online Games Over the Years19 maio 2024 -

😍Top Ten Online Browser Games19 maio 2024

😍Top Ten Online Browser Games19 maio 2024 -

Premium Vector Online games concept19 maio 2024

Premium Vector Online games concept19 maio 2024 -

Online Games on Reludi - Play Free Games Online19 maio 2024

Online Games on Reludi - Play Free Games Online19 maio 2024 -

Scrabble, Free Online Multiplayer Word Game19 maio 2024

Scrabble, Free Online Multiplayer Word Game19 maio 2024

você pode gostar

-

GLAMBAG OUTUBRO 2023 FEITIÇO DA BELEZA #glam #glambox #glambag #glamfe19 maio 2024

-

Wonders of Ancient Israel: Christian Heritage Tour19 maio 2024

Wonders of Ancient Israel: Christian Heritage Tour19 maio 2024 -

Chico triste para perfil de Facebook o Whatsapp, chico solo19 maio 2024

Chico triste para perfil de Facebook o Whatsapp, chico solo19 maio 2024 -

Mahjong Christmas - Mahjong Games Free19 maio 2024

Mahjong Christmas - Mahjong Games Free19 maio 2024 -

I Thunderman - Wikipedia19 maio 2024

I Thunderman - Wikipedia19 maio 2024 -

Oakley - Summerlin19 maio 2024

Oakley - Summerlin19 maio 2024 -

Teoria da Cor parte 3 - Instituto BH Futuro19 maio 2024

Teoria da Cor parte 3 - Instituto BH Futuro19 maio 2024 -

Tsurune - Wikipedia19 maio 2024

Tsurune - Wikipedia19 maio 2024 -

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2021/a/l/2GpYUZQR6xbdaAIyv12w/league-of-legends-wild-rift-preview-900x506.jpg) Wild Rift: patch 2.5 tem detalhes revelados pela Riot; veja o que muda19 maio 2024

Wild Rift: patch 2.5 tem detalhes revelados pela Riot; veja o que muda19 maio 2024 -

Doors professionals, does this count as a rare face in the seek eyes or not? : r/RobloxDoors19 maio 2024

Doors professionals, does this count as a rare face in the seek eyes or not? : r/RobloxDoors19 maio 2024