Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Last updated 02 junho 2024

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

IRS Counsel Memorandum Analyzes FICA and Income Tax Withholding

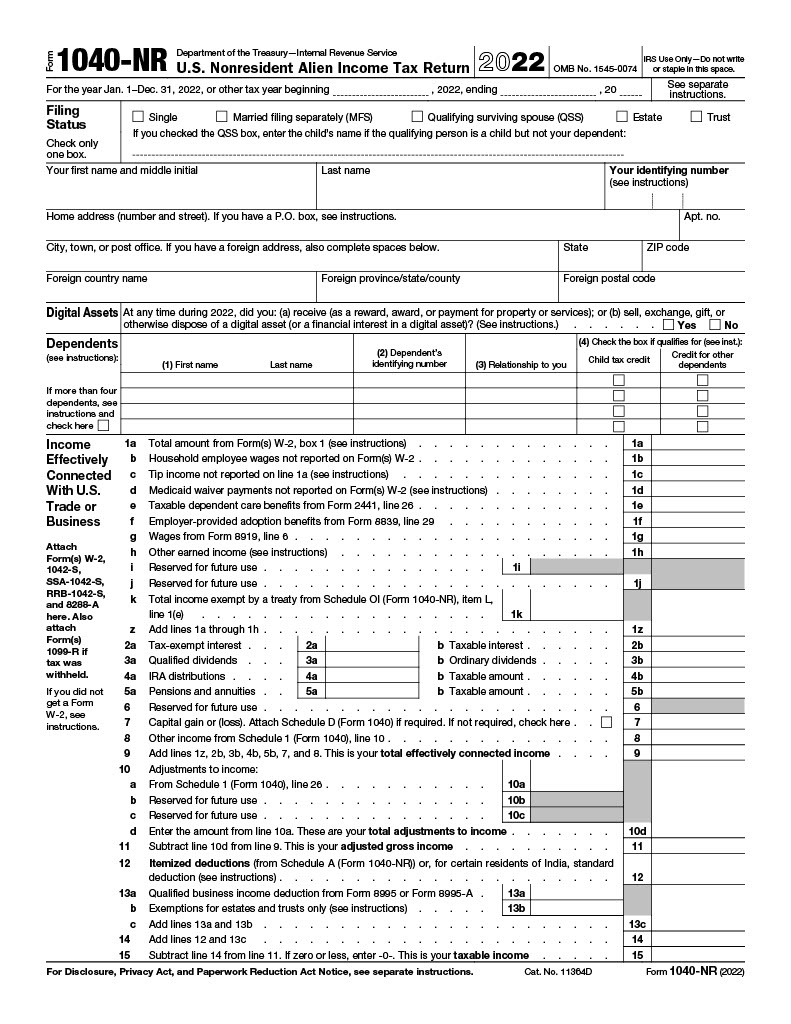

FICA Tax Exemption for Nonresident Aliens Explained

FICA explained: Social Security and Medicare tax rates to know in 2023

US Nonresident Alien Income Tax Return: Form 1040 NR

Foreign National Tax Analysis

Spain Payroll and Taxes: Everything You Should Know

The Complete J1 Student Guide to Tax in the US

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

How Remote Workforce Programs Trigger Myriad Tax Problems—Part One

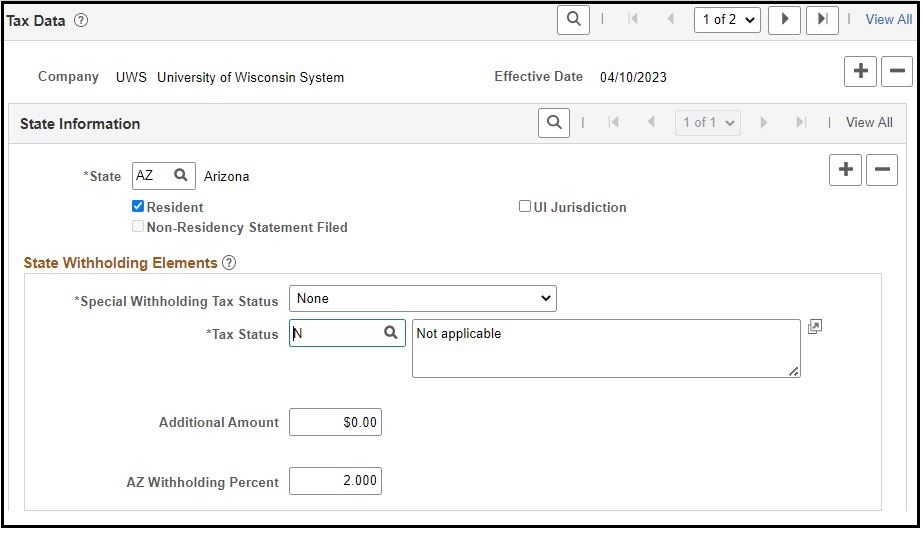

UW–Shared Services KnowledgeBase

Students on an F1 Visa Don't Have to Pay FICA Taxes —

Which Employees Are Exempt From Tax Withholding? - Payroll

Recomendado para você

-

What is FICA Tax? - Optima Tax Relief02 junho 2024

What is FICA Tax? - Optima Tax Relief02 junho 2024 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?02 junho 2024

Family Finance Favs: Don't Leave Teens Wondering What The FICA?02 junho 2024 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand02 junho 2024

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand02 junho 2024 -

Social Security Administration - “What is FICA on my paycheck?” Find out02 junho 2024

-

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents02 junho 2024

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents02 junho 2024 -

How An S Corporation Reduces FICA Self-Employment Taxes02 junho 2024

How An S Corporation Reduces FICA Self-Employment Taxes02 junho 2024 -

How Do I Get a FICA Tax Refund for F1 Students?02 junho 2024

How Do I Get a FICA Tax Refund for F1 Students?02 junho 2024 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student02 junho 2024

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student02 junho 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.02 junho 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.02 junho 2024 -

FICA TAX PROVISIONS (1967-1980)02 junho 2024

FICA TAX PROVISIONS (1967-1980)02 junho 2024

você pode gostar

-

30 Best PC Games of 202202 junho 2024

30 Best PC Games of 202202 junho 2024 -

Município de Viana do Castelo02 junho 2024

Município de Viana do Castelo02 junho 2024 -

Dragonball Evolution - CinePOP02 junho 2024

Dragonball Evolution - CinePOP02 junho 2024 -

É muita coisa: 18 jogos capazes de ocupar mais de 100 horas da sua vida!02 junho 2024

É muita coisa: 18 jogos capazes de ocupar mais de 100 horas da sua vida!02 junho 2024 -

Which character would you like to date in Sword Art Online,and why? : r/ swordartonline02 junho 2024

Which character would you like to date in Sword Art Online,and why? : r/ swordartonline02 junho 2024 -

The Spanish series Welcome to Eden arrives on Netflix02 junho 2024

The Spanish series Welcome to Eden arrives on Netflix02 junho 2024 -

ADFO 20 Inches Levi Reborn Baby Doll Bebe Reborn Real Reborn02 junho 2024

ADFO 20 Inches Levi Reborn Baby Doll Bebe Reborn Real Reborn02 junho 2024 -

Steaua Bucuresti promoted to Liga II (Romanian second divison) : r/soccer02 junho 2024

Steaua Bucuresti promoted to Liga II (Romanian second divison) : r/soccer02 junho 2024 -

Qsmp Eggs Projects Photos, videos, logos, illustrations and branding on Behance02 junho 2024

Qsmp Eggs Projects Photos, videos, logos, illustrations and branding on Behance02 junho 2024 -

The Fate of the Returned Hero - MangaDex02 junho 2024