Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 02 junho 2024

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

Social Security wage base is $160,200 in 2023, meaning more FICA

FICA Tax Exemption for Nonresident Aliens Explained

Payroll Taxes: What Are They and What Do They Fund?

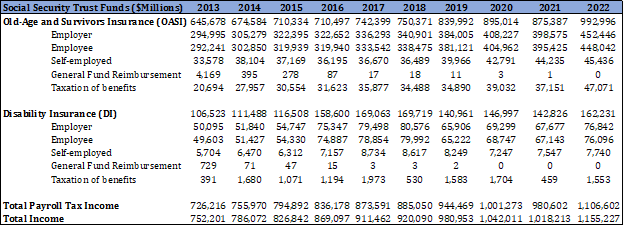

Social Security Financing: From FICA to the Trust Funds - AAF

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

Maximum Taxable Income Amount For Social Security Tax (FICA)

Self-employed and FICA Taxes - OSYB Number Crunch! Bookkeeping

Social Security Wage Base 2024

Social Security Administration - “What is FICA on my paycheck

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

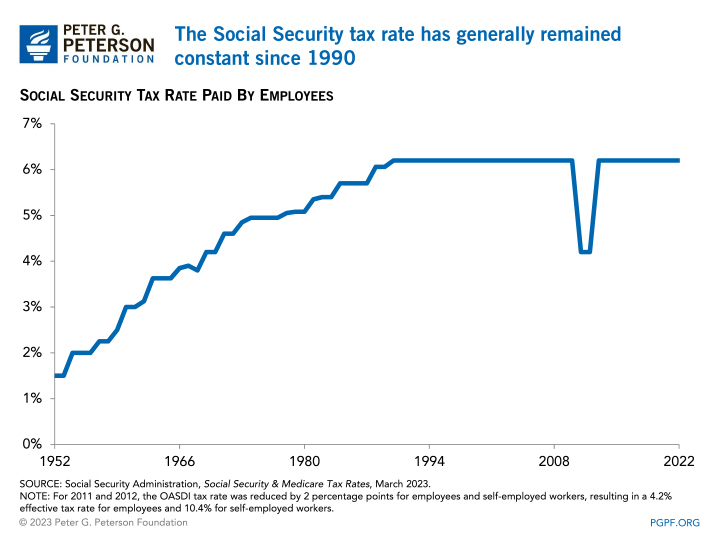

What is the FICA Tax and How Does it Connect to Social Security?

What are the major federal payroll taxes, and how much money do

What is FICA and why does it matter for Social Security, Medicare

What Are FICA Taxes And Why Do They Matter? - Quikaid

Recomendado para você

-

FICA Tax Rate: What is the percentage of this tax and how you can calculated?02 junho 2024

FICA Tax Rate: What is the percentage of this tax and how you can calculated?02 junho 2024 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202302 junho 2024

FICA Tax: 4 Steps to Calculating FICA Tax in 202302 junho 2024 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers02 junho 2024

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers02 junho 2024 -

Employee Social Security Tax Deferral Repayment02 junho 2024

Employee Social Security Tax Deferral Repayment02 junho 2024 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence02 junho 2024

The FICA Tax: How Social Security Is Funded – Social Security Intelligence02 junho 2024 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social02 junho 2024

-

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and02 junho 2024

-

What it means: COVID-19 Deferral of Employee FICA Tax02 junho 2024

What it means: COVID-19 Deferral of Employee FICA Tax02 junho 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com02 junho 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com02 junho 2024 -

FICA Tax Tip Fairness Pro Beauty Association02 junho 2024

FICA Tax Tip Fairness Pro Beauty Association02 junho 2024

você pode gostar

-

Como Criar CONTA NO ROBLOX (Rápido e Fácil) - Atualizado!02 junho 2024

Como Criar CONTA NO ROBLOX (Rápido e Fácil) - Atualizado!02 junho 2024 -

CRONOGRAMA INFALÍVEL PARA APRENDER INGLÊS EM CASA02 junho 2024

CRONOGRAMA INFALÍVEL PARA APRENDER INGLÊS EM CASA02 junho 2024 -

Pokémon Blast News on X: Tipos de Pokémon - Conheça as Vantagens e Desvantagens de Cada Tipo / X02 junho 2024

Pokémon Blast News on X: Tipos de Pokémon - Conheça as Vantagens e Desvantagens de Cada Tipo / X02 junho 2024 -

Add RP Sentry Discord Bot02 junho 2024

Add RP Sentry Discord Bot02 junho 2024 -

Top gun anthem free sheet music by Harold Faltermeyer, Steve Stevens02 junho 2024

Top gun anthem free sheet music by Harold Faltermeyer, Steve Stevens02 junho 2024 -

Shingeki no Kyojin: The Final Season Part 2 Dublado - Episódio 6 - Animes Online02 junho 2024

Shingeki no Kyojin: The Final Season Part 2 Dublado - Episódio 6 - Animes Online02 junho 2024 -

Off-the-Job Safety - Posters by Topic - Posters02 junho 2024

Off-the-Job Safety - Posters by Topic - Posters02 junho 2024 -

Comparison of Three of the Best Sites for Playing Board Games Online For Free - Ask The Bellhop02 junho 2024

Comparison of Three of the Best Sites for Playing Board Games Online For Free - Ask The Bellhop02 junho 2024 -

The Best Order To Watch The Fate Series!02 junho 2024

The Best Order To Watch The Fate Series!02 junho 2024 -

Magu Magu no Mi, Grand Piece Online Wiki02 junho 2024

Magu Magu no Mi, Grand Piece Online Wiki02 junho 2024